How much can i borrow if i earn 35000

Here are some of the key facts. Yet its also worth checking if you can then up that amount by going direct to the insurer through Topcashback and Quidcos normal sites.

35000 A Year Is How Much An Hour Good Salary Of No Money Bliss

Over 80 of applicants choose in-school payments thanks to this feature.

. You work hard to earn your money and we dont think you. Lenders use your financial history to decide if you qualify and how much you can borrow - it helps if you have a good credit score and have kept up with debt repayments before. That being said most individual mining is now done by joining a pool.

From 35000 Virgin Points. 1 See contest rules for full details. This means that you can borrow larger amounts in this way and negotiate more affordable payments.

Joining is simple and doesnt need to cost a lot. Student loan borrowers can run payment scenarios to ensure they make the right payment choices. Finance or refinance an auto loan for a chance to win free gas for a year.

Applicants can call webchat or email a knowledgeable Client Happiness rep who will answer any questions. I moved to him and put my arms around him. Your credit limit is the maximum amount of money you can borrow with a credit card at any one time.

How much you cover makes a difference. Card companies offer reward schemes to encourage you to spend on their cards so they can earn interest from you. Loans between 3000 and 35000 with a duration of 1 to 8 years.

Plus free up some extra cash by taking advantage of No Payments for 90 days. Topcashback gives 33 when you buy through its comparison and Quidco gives 28. For example if your credit limit is 5000 youll earn points on the first 5000 of card purchases in a month.

You and your spouse can each withdraw up to 35000 from your RRSP. If you dont repay a reward card IN FULL the interest cost will dwarf any gain you get. We dont have ads so we depend on our members 35000 and counting to help us hold the powerful to account.

Move home with your mortgage. I thought of you as my brother His face tensed and tears filled his eyes. 2 lucky winners will each receive a pre-paid gas card good for 3000.

35000 Earn uncapped Qantas Points for every 1 dollar spent plus an ongoing 0 annual fee. Under the federal governments Home Buyers Plan first-time home buyers are eligible to use up to 35000 in RRSP savings per person 70000 for couples for a down payment on a home. It requires you to borrow stock from your broker sell it at the prevailing market price or higher wait for its price.

If you spend more than that then you wont earn points on any. The main difference is that installment loans are paid back over several months as described in your lenders contract. Builds cash value that you can borrow from.

Dont forget you can also leverage your RRSPs. Using US Installment Loans you can potentially be approved for a loan of up to 35000. This is the amount you can earn without paying any income tax.

You may be able to borrow up to 100000 if you qualify. Kat Tretina is is an expert on student loans who started her career paying off her 35000 student loans years ahead of schedule. But can you earn enough to pay off your mortgage.

As an investor you can earn profits on the stock exchange differently. Every auto loan booked by August 31 st earns an entry to win. Why SoFi is best for high borrowing limits.

Lenders presume borrowers spend about 3 to 5 of their outstanding debts on servicing costs. Enter the amount of money you plan to use as a down payment. Contrastingly homeowner loans range from 10000 up to 2000000 over terms of 1 to 30 years.

Machines of this caliber are pretty much required for Ethereum and Bitcoin mining solo. You can become a. In our above calculation for individuals we subtract 3 for each 1 of debt for individuals and 24 for each 1 of debt for couples with multiple income providers.

As the debt is already so big and. Must be over 18 and UK resident. I wiped them away.

The added debt is essentially meaningless. And if you earn any amount of income you are legally required to pay income taxes on that money. Ask your financial planner if this.

These systems can go for over 30000 depending on the specs of the computer. Most applicants can complete the application within 10-12 minutes. Individuals can borrow up to 40000 to consolidate debt or.

Compare low APR personal loans from 1000 to 35000. You wont want to pass this up. However the money you borrow from your RRSP wont earn the tax-sheltered returns it would if left in your account.

The amount youre eligible to borrow will depend on your credit history and personal circumstances. The Home Buyers Plan allows you to borrow funds from your RRSP to purchase your first home. Were proud to earn a super-positive score from.

There are mining rigs that cost less than 1000 that can earn rewards as part of a crypto mining pool. Over the past few years you might have seen a lot of hoo-ha in the news about the government increasing the interest rate on Plan 2 Student LoansWhile this is technically true and were against the principle of students being burdened with extra debt there is a very important point to stress. The points you can earn each month are capped based on your credit limit.

The death benefit is guaranteed never to decrease. Pros Cons Caret Down. If you are a first-time home buyer you can borrow up to 35000 from your RSP towards your down payment.

However if you do not earn an income or earn very little income you can claim the Basic Personal Amount non-refundable tax credit when filing your taxes. By running a comparison based on how much you want to borrow for how long and. How Much Can I Borrow.

Policy cant expire at any age. Typically personal loans range from 1000 to 35000 over terms of 1 to 7 years. Then check to see if cashback sites can beat the quotes you got above.

The latest travel information deals guides and reviews from USA TODAY Travel. I think it was the look in his eyes. Theres too much Mitch in there.

You will not be declined due to common health issues like diabetes or high blood pressure. If you need to borrow as well youre far better off focusing on getting the lowest interest rates thatll save you much more money. I cant go in I said as my eyes moistened and tears began to roll down my cheeks.

Many lenders cap personal loans around 40000 or 50000. The most unique and valuable feature of final life expense insurance is that seniors with virtually any health issue can qualify. First time home buyers can withdraw up to 35000 in a calendar year from their RSPs for a home purchase up to 70000 for a couple.

They then have 15 years to repay their RSP other conditions apply.

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

35000 A Year Is How Much An Hour Good Salary Of No Money Bliss

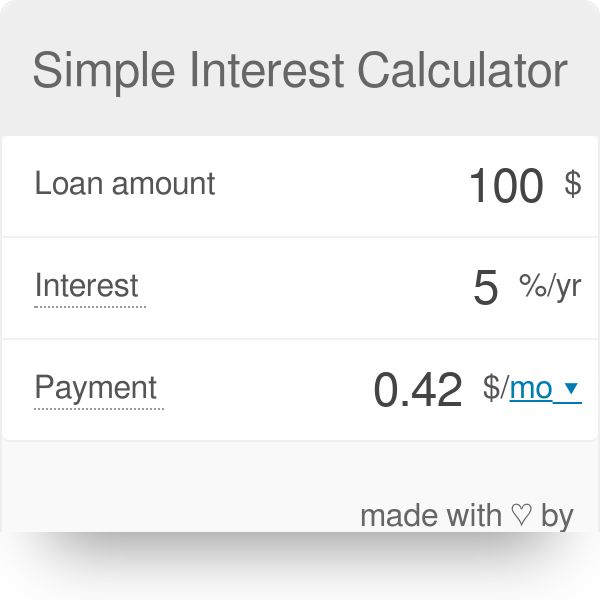

Simple Interest Calculator Defintion Formula

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Get 35000 Personal Loan In The Uk Compare Online Loantube

What S The Cheapest Way To Borrow Money

:strip_icc()/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Ww7onplf S1ckm

What Are Interest Rates How Does Interest Work Credit Org

How Much Mortgage Can I Get Mortgage Guides Yescando Money

How Much Can I Borrow Home Loan Calculator

How Much Can I Borrow Home Loan Calculator

Hard To Borrow Fee Calculation Ally

Personal Loan Calculator Student Loan Hero